Parabolic extension

- Jan

- Feb 26, 2020

- 13 min read

Updated: May 24, 2021

In the trenches of the trading industry, it is frequent to see that specific terms get stretched and over-used, and parabolic extension would fit this example.

Strong being equaled to parabolic are two common words that are being displaced with each other often. This article will outline some of the specific characteristics that parabolic move has as a specialty that is not necessarily present in just any strong move by itself.

A common misconception is that traders tend to call anything that goes up 50% in a day a parabolic move, or a ticker that goes up to ten candles in a row a parabolic, or anything that looks strong by observing eye, being already a parabolic by itself.

As a trader, the main outline is that knowing the behavior of the actual parabolic pattern is essential along with its expected statistical performance. Thus, separating setups from each other and not calling an orange an apple just because they are both fruits. Valid parabolic setups have specific behavioral data that is different from just any "strong" move. This article will outline some of the variables that traders should look to better define what might not be a parabolic move.

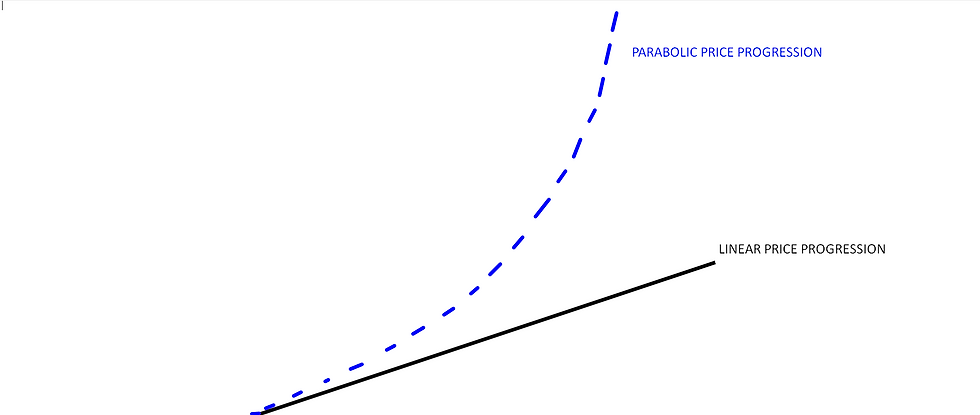

Parabolic versus linear progression

Differences between parabolic/exponential and linear price progression (by judging the curve of price progression) are shown in the images below. The data quantity impacts the ability to define it correctly.

One thing to note, to see the price curve/progression correctly; it is rather essential to see the price move from the right angle, which means using the suitable time frame. If a certain factor shrinks data, both curves become more or less linear progression curves! That is why having enough price data (enough candles within the whole move) is an absolute must. Below is the conceptual difference between using data factor 5X vs. data factor 1X to see the price progression as the curve. 5X stands for five times as many Japanese candles in price move relative to 1X. Or with other words, 5X could stand for a 1-minute time frame, while 1X would stand for the 5-minute time frame (5X has five times the amount of candles).

Below is an example of a 5X data factor:

And on the example below it is the same exact setup as above but using only 1X data factor (5 times fewer data samples or candles in the move, looking from a much higher time frame):

As the images show, the problem of the second image example is that both curves start to look the same; they both begin to look linear. Because when the number of candles inside the move is shrunk down, the steepness of linear move increases, but the parabolic move does not have enough data itself to stand out from the linear move, so they both start to look similar because not enough data was included. Thus it is essential to use lower time frames to define parabolic setups more accurately and having as many candles within the move as possible.

Using low time frames over higher time frames

Looking at parabolic extension through the right lens is critical, one of the essential steps that should be taken to avoid over-fitting. The main issue of traders fitting any move into parabolic is usually they look at the action from the too-high time frame, with too few candles in the whole structure (as already mentioned in the article above). The more candles in structure, the more apparent the potential U curve might be, along with all the rest of the rules that follow the ideal parabolic play.

Using the above principle, on Bitcoins parabolic rally of 2017 as an example, looking at the same move from 2 different time frames, wherein first case parabolic curve progression is visible, while in the second it no longer is visible due to too little data/candles it starts to become just a steep linear progression.

Using lower time frame (Daily) where the parabolic curve is visible on price progression from the base up:

And using a higher time frame (Weekly) where the parabolic curve is not visible and instead becomes just a steep linear curve:

Using the correct time frame plays a vital role in determining if a move is or is perhaps not a parabolic move. And it is all about balance; after all, choosing too high a time frame and any move becomes a vertical linear move or picking too low a time frame, and there are too many candles for a trader to even see where the movement started in the first place. The middle ground is where the proper use will be. However, this will depend a lot on many factors, and there is no specific single time frame that has to be used, as it all depends relatively on how long the whole move takes to develop from base up (in terms of minutes or hours). But a very rough rule that one should follow, to determine curve at least 20 candles should be present in the whole move, that is the bare minimum, but in most cases, the number should be at least 40. Anything under 20 and the move is guaranteed to follow the linear and not parabolic curve in most cases.

No major retraces in the move

The parabolic move should be progressing with no major retraces within the movement, no deep lows or highs that go counter the whole move. Mind that parabolic move is not just an uptrend or downtrend; it is a very strong progressive move with consistent one-sided candle prints (bull candle after bull candle, for example) and no major deep retraces in between, all the way to the end of the move.

Example of what is meant as the depth of retrace between just trending move versus parabolic move on two images below.

Parabolic move example with soft retraces relative to the steepness of the curve:

And below is non-parabolic example with deeper retraces against the curve, relative to how steeper is curve getting.

First example above fits much closer to parabolic state compared to second image under, as the ratio of curve steepening relative to retrace depth is important.

Price and volume should both follow an exponential curve

The difference between what is and what might not be a paraboler on the image below, using the above rules. Both price and volume should equally follow the parabolic progression, not just the price itself. More and more volume should be flooding the asset as the ticker progresses toward later stages of parabolic state. Thus to define an actual parabolic setup using a volume is a must; price itself does not define the extension accurately enough.

Heavy extension candle on rejection

The ideal entry on parabolers will be to wait for a heavy extension candle with very strong rejection and the highest traded volume in the whole move.

1. Highly extended candle (biggest candle in the whole move, or at least one of the biggest)

2. Candle rejects strongly and turns into a pinbar on high volume (either on extension candle or the next candle after it).

3. Price does not reclaim or retest that level, and it turns into the straight top.

4. On that last extension candle, the volatility should expand the most in the whole move

Example of parabolic extension on ticker CNAT with heavy extension candle and topping on it:

Trapped longs at the top to help with cascade

A high volume on extension candle should be present to help to create a cascade. Trapped longs that have chased on top should flush out once price starts to reject down from the buyers who were buying from lower.

The higher the volume on the extension candle, the better, as that can provide more fuel for those participants to sell out as price starts moving down, preventing any fresh bidders' ability to hold the price up.

It is often worth noting in trading who has taken a position where or where the highest portion of volume trades might provide some insight into where the cascade might go if counter directional move starts. This is only semi-conclusive since the trader can't know for sure if that high volume on extension candle were longs chasing the top or a large amount of shorts covering into panic extension; there is always a portion of guessing that trader will have to do.

Price profit targets on parabolic plays

In most cases, A-grade parabolic moves will reverse relatively quickly; the rejection will be swift and fade at least 30% of the whole parabolic move. This should be within traders target, but the target could be larger depending on what drove the move; as explained in the article below if liquidations are the main cause of the move (heavy short squeeze), then fade could be much deeper than just 30% once the liquidation is done, or if the parabolic move was due to market hype, the fade could as well be deeper. But the main practical rule to follow is minimal target should be 30% of the whole move (as per collected data across many parabolic setups):

A conceptual example of what is meant as "30% target":

A trader needs to judge where the move originated from, where the base of the move started. Volatility in the price movement at the base level should be much lower relative to volatility at the later stage of parabolic move (to identify base correctly).

Combo setup for better accuracy

A practical way to increase risk-to-reward on parabolic setups is to combine two setups on different time scales in terms of development or size. It combines a macro set up with a micro setup, using the micro setup as entry and risk trigger, while using it as a start of the cascade to complete the macro setup. This can increase RR on trade by itself, although the downside is that it might not work with a high degree of %. Still, the RR over a while should weigh it enough into positive favor.

My preference is to use micro-distribution (B grade) or heavy weakness (A grade) as a micro pattern for entry. Example of such pattern combined after the initial parabolic extension candle (conceptually):

There can be a number of any other micro patterns that traders might use, such as tape / Level 2 stuff, heavy orders on tape, or indicators if they can provide a tight risk method.

Parabolic examples:

Parabolic setup on crypto-currency / altcoin:

Below is an example of B grade "soft" parabolic setup on ticker WORK. The difference of this setup versus A grade setup is that the setup below has only soft U curve progression of price and volume (much closer to linear progression rather), and there was no clean high volume rejection candle at the end stage of the move, B grade setup.

The same rules apply for the parabolic crash as for a rally

Examples given in the article are bullish parabolic rallies, but the exact same rules apply on parabolic crashes (inverse setup). It is just statistically somewhat more likely to find the bullish setup for such a case rather than a bearish setup.

Understanding position sizing with R units

With parabolic extensions, it is critical to understand how parabolers tend to behave and correct R sizing works in all markets. Failing to understand each of those components could leave traders exposed to significant losses.

Knowing parabolics behavior means that the trader fully understands if he or she is too early trading top and being wrong, to have a realistic expectation that like the counter move higher could be very swift and explosive, as usually, parabolers tend to expand in volatility on each step more and more.

Additionally, the trader needs to know what position size should be used relative to the potential volatility expansion that could create against the trader's initial position. It is worth noting that at the later stages of the parabolic setup, volatility is very strong, which means that traders should be using smaller position sizes than usual. Otherwise, the risk in dollar amount or % of equity can easily get too high.

To learn more about R sizing, read the article on this blog about how R sizing works or many other sources online.

When to avoid trading parabolic extension

One thing to note as well, macro understanding conditions can be conducive, especially when trading parabolic setups on large-cap or more considerable liquid assets. If a specific huge catalyst drives the market in a particular direction, then trading parabolic setup could deliver consistent and frequent losses.

For example, suppose a trader could trade parabolic crashes during the 2008 market crash on large-cap equities. In that case, the performance could be poor, as the market could not find the bottom, even though that many assets were parabolically extended. The extensions just kept getting deeper and deeper, and each bounce failed to deliver (across many large-cap tickers). This is usual behavior when a powerful catalyst tears the market in one direction, which in most cases is a bearish catalyst. It is far less likely to find market behavior where bullish parabolic setups keep going and not crashing (such as the 2001 dot com bubble); in most cases, it's a financial crisis or liquidity crisis driving a bearish parabolers to fail to deliver the bounce.

It helps to know if such a strong catalyst is present and avoid trading against a parabolic setup to catch the top or bottom.

Do not look at percentage % to determine when the top is coming

One of the common mistakes of traders is that they base the chances of topping or bottoming based on how many % up on a day the asset is. For experienced traders, look at many variables and have experience of seeing assets that went beyond everyone's expectation that might not be the problem. Still, it is a prevalent problem with beginner traders. Just basing the "it can't go any higher" thesis by glancing on 100% or 200% on a day move is undoubtedly an easy way to get in trouble. And the reason being that with the too simplistic method, the trader is much more likely to get "caught with pants down" as he/she is missing too many pieces on what it takes to "nail" the top or bottom on strongly extended asset and even more importantly, to know when to cut and revisit at reasonable next extension, or to rather entirely avoid.

That is why % based extension was not added as one of the rules on the article in terms of what defines a paraboler because that rule by itself is very easy to mislead traders, as it is the most simple rule to look at situation and traders tend to ignore everything else. There is something within human psychology that makes everyone doubt that if an asset goes up 100% on a day, it "surely" can't go any higher. And often, the pessimistic/optimistic mindset of individuals will play a huge contribution to that. Pessimists tend to see 100% rallies as sure tops, while optimists might be more inclined to chase there, expecting another 100% move.

An additional example might be where specific extreme short positioning and constant squeezes cause parabolic setup to keep extending and extending, such as ticker DRYS in 2016. This is an example of an asset that went up 100%, then another 100%, and more.

Parabolic setups require very strong patience, and even more so the discipline on cutting losses and potentially revisiting the play on re-entry, rather than adding to size. It is straightforward for traders to get into the mindset of "there is no way for this ticker to go any higher," and yes, in many cases, that will be true, but those few which will go much further beyond are the ones that will test the trader on skills of discipline, having complete faith into the thesis is not a good idea on parabolic setups, especially if using margin and leverage.

The reason behind the move

Knowing the reasons behind the move or having some pointers toward the short positioning on the asset might give the trader better insight into how far the bullish parabolic extension might crash. Generally, in small caps, parabolic setups will crash very hard (even up to 100% of the move) if the move is caused by heavy short squeezes (liquidation) such as tickers DRYS (2016) or CLVS (2019), and many others.

While in large caps, short squeezes might be more sustained, and the paraboler might drop only 30% of the whole move (TSLA 2020). If a parabolic move is caused due to market hysteria and huge hype (crypto 2017), that might also serve as a deeper target on the drop of the parabolic rally.

Often liquidation (short squeeze) parabolers tend to fade a lot better and stronger (70+% fade) compared to organic parabolers.

Especially on weaker assets with soft demand (small-cap stocks), this applies even more. If an asset is running parabolically due to being pumped by certain service rooms often seen in crypto or back in 2015 in pink sheet stocks, the crash will be much stronger and swifter.

Very difficult setup to trade

Especially for traders who are too confident in their thesis or unwilling to cut losses, parabolers might be problematic. Parabolic extensions are often part of strong liquidations. Many traders keep shorting into "overextended" assets while the top is not yet there; this can be seen time and time again. And this issue mainly comes from not knowing the setup well enough to know how to time it well or how to handle risk with proper position sizing.

The core issue is that if one has a too over-simplified rule in what is a "highly overextended asset," then trader might start to trade against the move and keep adding to the position, as each step as the price goes against traders initial position the more "overextended" the asset is, which feeds into the false perception that the more price goes against traders initial entry, the more the trader is likely on the right side if he/she just keeps adding as it feeds into the "over-extension" thesis more and more. And such thinking could be dangerous where the trader just never cuts the loss until the volatility expands significantly and is already too late.

Using specific indicators such as Stochastic or RSI can also be highly problematic with the trading of parabolers because the indicator will keep displaying trader what he/she wants to see, which just re-affirms trader to stay in and add more size (keep getting into oversold territory more and more). In my personal view, indicators should be used so that they fit a specific setup well; not every indicator makes good use for every setup or every market.

Frequency of play

Quality parabolic extensions are not that frequent; they should be pointed out straight away. This setup is not ideal for any trader to focus on as a "single" play in his/her playbook since it is not an easy setup to trade, nor is it an easy setup to find. It is, however solid setup to add into the playbook as contributing play.

Conclusion

Parabolic setups are great complimentary play to have in the playbook and can provide the trader with a better understanding of how extreme market conditions create strong reversals. Additionally,, they can help sharpen traders' discipline and "topping" or "bottoming" skills, which traderstraders should strive to improve.

Trading paraboler using the rules and approach defined above in the article is not about "catching a falling knife," the common term used in trading when someone is stepping in front of a train, trying to catch it just when it will stop.

The methods above suggest instead trade after initial rejection where large counter-order flow shows up and using combo variables of tape or secondary setups to time entry better.

thanks Jan