Supply takeout / absorption

- Jan

- Jul 22, 2019

- 11 min read

Updated: May 9, 2021

One of the consistent micro patterns present in very liquid markets is supply absorption/takeout around potentially bottoming price structures. Those patterns are common to all liquid markets such as large-cap equities, Forex currencies, crypto, and futures. Certain aspects of this pattern are also explained in the article "Trading ask stacks."

Consistency of behavior and its change

Watching how structure develops is key to spot the critical moments when the behavior changes and buyers start to press into supply/resistance by buying up offers. Generally, if big buyers are aggressive at a high price at active supply, it is usually for a reason, could be to remove the blockage and clear the path for the general market, but there could be many other reasons as well, in some cases to set a trap for longs.

For trader to spot behavior change, the first thing behavior has to be is symmetric; otherwise, it will not be noticeable to a trader. The structure has to be clean with evenly positioned highs, with clear positioning of offers around highs (tape, limit books).

Ideally the structure should have progressive higher lows (for example 3 consecutive higher lows) which indicate consistent behavior.

Edge

Those patterns are relatively thin on edge, meaning that it requires patience and executing several plays for edge to come through with the positive performance. That is due to the behavior of the pattern itself, approximately 70% of patterns will form supply takeout and push, but only 60% will complete it with a move that is over 1R in size relative to whole structural depth, or in other words, if structure size is 10 units, only 60% of patterns will actually form move that is 10 units or bigger after pattern emerges. This, combined with tight risk management, creates softer performance expectations if the trader uses 1% risk per trade, where 10 trades could potentially return around 5% gain if plays are executed well. It requires solid discipline to respect the stops on play and be patient on profit targets; otherwise, edge decreases. It is the type of setup where the discipline has to be followed well because any "winging it" action contributes quickly to diminishing edge.

Frequency of play

The pattern is frequent in very liquid assets across most markets (6E, GBPUSD, MSFT...). It requires well-set trade management and asset tracking plan and the use of alerts to help traders decrease screen time. Alerts can be placed at critical break or bounce levels before or after the pattern emerges. Also, volume alerts or tape (big bids or offers soaked) can be used to help with trading this pattern.

Introduction to the setup

Core mechanics behind the setup is supply and demand shift within dense bottoming or topping structure. Traders should be looking to catch the squeeze when the key shift inside the structure happens. The squeeze initiated from the sup / dem shift could be the case of a large player absorbing on bid / ask a large number of orders to build a strong position and form the bottom/top on the asset, or the move could be the consequence of short squeeze that is initiated once major highs in the structure are taken out. For the most part, if either of the above is true, the setup should work pretty much straight away with minimal drawdown, if there is a substantial counter-move on the critical setup confirmation point, likely, dynamics for the setup are not there in the right magnitude, and the setup will fail. For that reason, those setups should be traded on relatively tight risk (relative to structure depth).

Basics of setup

The basic structure of supply absorption/takeout pattern:

Therefore for valid supply takeout pattern structure should have these components:

- clean stage 1 ahead of it

- does it have stage 2 (both of those stages are a must)

- does it have stage 3 (optional, but its a plus)

The most important stage 4 is a momentum takeout, or if not that, at least an obvious micro shelf buildup with offers soaked at supply.

Looking at the setup from this stage-to-stage perspective will remove traders' confusion and help identify if the play's structural composition fits the play.

In reality, the setups will vary conceptually how they look, it's all about order flow; therefore, the grade of setup and potential of reward on it will also be very much determined from 3 "external" factors:

-consistency of symmetry

-consistency of consolidation

-heaviness of one-sided order flow positioning (for example, very strong short / offers to position on the supply level of price).

That means the supply takeout setups are usually split into few different versions:

Several different versions of this setup will emerge in markets, based upon how the supply will be distributed inside the structure. The setups are presented for bullish plays mostly here, but the same goes for bearish setups just flipped upside down.

Entry and trade management

The first stage should be for the trader to wait for the structure to set up along the 4 stages explained above. Once this is confirmed trader should start planning the entry. One major rule trader should follow for entry: Always wait for the whole area supply to be taken/absorbed before entering. Or, with simpler words, all highs should be taken with price trading above them before the entry should be considered. Simply for the fact that this will decrease the chance of price being rejected again from the supply level. I am pointing the rule above because the statistical data overlap very well, with a higher chance of supply to be taken out if trader waits for that key absorption. This rule is based on performance chances, rather than this being a must to do on how to trade it.

The second part should be setting your SL (stop loss) or being ready to cut the trade if it does not work out. Stop-loss should be a maximum of 50% of the last leg distance from high to low. No more than that, why? Because that is the average performance rate of the winning setup, the drawdown is lower than 50% of that distance on the majority of winning setups. This is based on hundreds and hundreds of setups collected and the behavior data on them. Again it is not a must to trade that way, it is just the most optimal way of following the best statistical route. But in the end, each trader can trade with their own style as long as long-term performance is there (for example, some are much more comfortable buying on dip ahead of expecting the takeout, rather than waiting for "confirmation").

On taking profits, a trader should be patient to wait for the solid move to develop, at least 1 R size of whole structural depth or, in other words, 2:1 RR on trade minimum. Profit-taking is a must to be taken partially in chunks! There is no advantage in taking profits in one single exit, partial profit-taking always has an advantage in the edge. But trader should do it with limit orders on markets that charge round trip commissions like equities or futures in order to reduce cost.

To sum it up:

-always wait for all highs to be taken out before entering

-set stop loss at a maximum of 50% of last leg distance

-profit-taking should be done in chunks of 2, 3, or 4 exit orders rather than single exit

Bellow is the conceptual presentation of trade management on setup (left setup with micro shelf for very tight risk, right normal - typical setup with slightly looser risk):

Micro

It should be noted that the trader needs to have some macro reason why he/she is trying to buy this potentially bottoming structure. There should be some overlapping macro reason such as catalyst or trend rotation due to whichever reason. This is a micro setup only and should be used with a combination of some broader reason on why traders should be engaged in a trade-in first place.

The importance of the last leg

The last leg that setup takes out the supply is crucial, it should be a powerful move; the market maker needs to reveal their hand and show strong initiation. There is no point trading those setups without strong demand shift because otherwise, the trader is doing too much guesswork on what price might do after it passes through the supply. Thus last leg move (the one where price breaks supply) should be very strong and possibly on solid volume, or at least it should form a micro shelf at the supply area, showing that buyers are constantly soaking up offers at supply. The tape should confirm strong buying at the ask, showing aggression of the market into offers. If the last leg is not strong, a trader should avoid taking a trade.

Below are some setups with especially strong last leg where supply was breached on the strong push:

Importance of symmetry

One of the key drivers of this pattern is a dense structure with established supply symmetry. This means that highs within the structure (supply rejections) should be established within a similar price area, ensuring that most short orders will be around a similar price, using a similar area to stopping out (good to fuel to move). If the structure is not symmetric on the positioning of highs, at least up to a good extent, it is not worth taking the setup because there is less chance of cascade reaction move following if the supply is breached. When structures are clean and symmetric more traders will look and take note of the same price levels, no matter what trading approach they use. Symmetry draws all humans together when something is obvious and clean, this helps to create strong fueling moves often in markets.

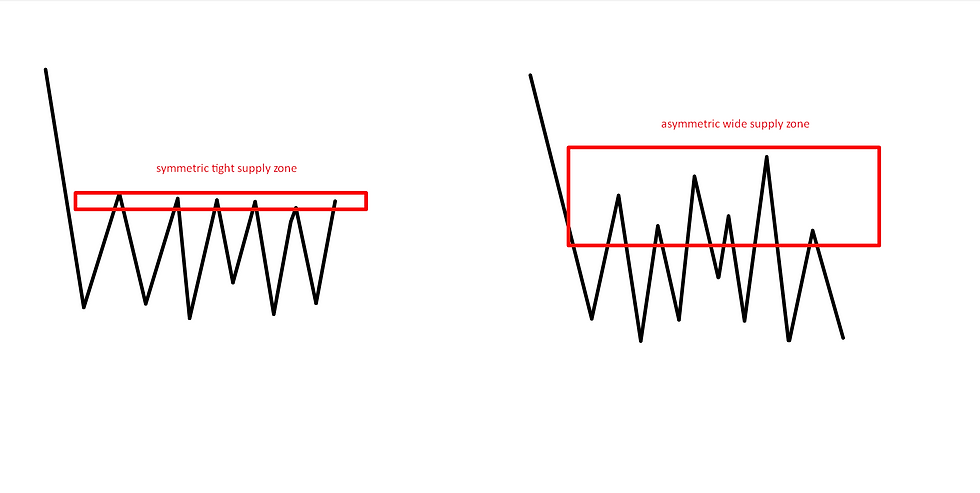

Below is the conceptual presentation of symmetrically distributed supply on the left, and on right side example of asymmetrically distributed supply:

Rounding with higher lows rotation

Another good variable for A grade play is to have structure progressing from weakness (lower lows) into stronger bids (higher lows), while the highs remain equal. This rounding progress showing bids picking up at higher prices while pressure into supply remains even and present. Structure needs a minimum of 5 lows/highs in it for this effect to be visible. All those variables at the end matter for better quality plays as they stack on top of each other.

Such example with rounding bellow, but for demand takeout (flipped to supply takeout):

Statistical data guide

Below is the statistical count for timely response and DD (drawdown) on 125 A grade examples of supply takeouts on Forex currencies using strictly M1 charts, futures for volume data, and tape (mostly collected during major surprising news events on the dollar, pound, euro and few other exotics such as MXN and TRY).

What was included in this count is only setups with strong and clean symmetry of behavior and also a strong momentum leg that performs the takeout (last leg in structure).

What was counted is how long it takes for the price to respond in upward direction after taking long trade, and how much drawdown was on trade overall before the price hit the profit target. Losing setups were not counted in as it only matters for winning trades for this behavioral data collection.

Data results strongly suggest that there is no point in using larger SL (stop loss) than 50% of the whole last leg distance (or average structural depth) as data is heavily concentrated around a minimal 10% or less DD (of whole last leg distance before takeout) on the majority of setups. For anyone trading those two patterns, this is vital data to recognize and validate how risk management should be handled, the way trader should manage trade should be determined strictly from how pattern behaves and not what trader finds the most comfortable, otherwise, the edge is decreased (but the best natural method is to start with comfortable risk management and then step by step start adjusting it towards what statistical data says). Forming trade management (where to cut losses or take gains) should be concluded from statistical pattern behavior data + current live order flow.

Data with 125 counted examples on 1 minute charts:

-100 examples performed with less than 10% of the whole last leg distance of DD, which means minimal DD and price responding with strength quickly into the direction of expected move, which means 1 minute on most examples. That means 80% of examples fit such behavior.

-22 examples had DD between 20-50% of the whole last leg distance and took them 2 - 5 minutes before the price went into 0 DD territory and then hit the profits. That is a total of 17% of examples.

-3 examples had DD between 50-90% of the whole last leg, which took between 2 - 8 minutes before the price hit the 0 DD territory and went into profits. That is a total of 3% of setups that fit that.

To put the data into the picture:

Data above is critical to follow when it comes to supply takeout plays, as it provides a very rough and robust outline on how traders should approach such setup, leaving little room for doubt or guessing.

First bounce

There is an overall decent chance that if supply takeout is successful and delivers a push upward after breaching the supply, the price will bounce if that same supply level is retested to the downside, in about 60% cases, the price re-tests that supply. A trader can use that area for a potential long entry play zone. Those re-tests and bounces can often be quite sharp and accurate, with price cleanly bouncing from major underwater resistance up to almost no under-over move. But that is not always the case; this is, however, common behavior in successful bounces.

After the first bounce, the statistical chances for the next bounces to be successful decrease, with 2nd and 3rd bounce dropping in a chance of delivering further bounces if retested. This is based on data of 570 collected samples.

This concept has as well been further explained in the article "Underwater level rejection."

Below is a conceptual example of the first bounce:

Example of symmetrical supply level and clean progression of higher lows into the supply level (ideal variable), cleanly indicating that buyers are trying to absorb the selling supply with pressure upward.

On the image below an example of the symmetrical range, washed under lows, quickly reclaiming and then forming supply takeout with further rally once key supply is breached.

The image below is an example of demand takeout (as opposed to supply takeout) the same principles apply, just inversed. The structure below is very low-liquid which is not ideal, the lower the liquidity the easier can price overshot clean supply or demand levels.

The last image on ticker EURGBP is an ideal example where the range supply level is very clean and symmetrical, and the breach of supply is on the very strong leg, resulting in a clean squeeze higher. The ticker is as well highly liquid, just after key economic catalyst for the British pound (GBP).

Examples of supply takeouts or absorptions:

On image example of ticker AAPL with large depth of supply structure, and then micro shelf build-ups into supply, consistent absorption of offers, until all offers were soaked and price popped higher quickly. This is ideal of how supply takeout setup should progress but in most cases it will not be as clean.

Example of lower liquid ticker of USDCNH on the image under.

Below an example of supply takeout play (using call options) on SP500 index after FED rate cut announcement (buy the rumor, sell the news, and then relief rally play):

Supply absorption in downtrend rotation on the example below on crypto ticker Ethereum. When price behavior becomes very consistent with consistent lower highs progression, it is easier to note from the price and tape when rotation takes place (downtrend into the uptrend) , because it is easier to isolate variables of micro rotations such as higher lows stepping up into offers or supply.

Microshelf around supply level in a clear downtrend will often be the sign of rotation, as buyers aggressively absorb the offers at a higher price. Notice how symmetrically the downtrend is progressing in the example below. Those kinds of examples are what traders should be patient and wait for as such samples behavior change with micro shelf stacks will be more clearly visible and action on Level 2 / tape.

Below macro plus micro combo conceptual of the above setup on ETHUSD:

Below is an example of demand absorption (inverse of supply absorption) with clear weakness into key demand levels just before the breach.

Example of trend rotation or accumulation, followed by pressure into supply with higher lows, just before the price pushed higher on ticker WMT below.

Example of demand takeout on ticker AIG, followed by slower selloff after the key level is breached.

Example of demand takeout, followed by a retest of underwater demand and rejection twice of the same level.

Conclusion

Supply takeout (or demand takeout as the inverse) is a very common micro pattern, present across any liquid market, and a well worthy to study as it expands traders playing field with few extra opportunities regardless of market traded.

There are as well many combinations on how this setup can be traded, whether it is on a direct takeout of key supply or demand level, on a retest of such level, or just on reclaim of key levels. Many secondary plays use supply takeout as a core and build upon it (such as short traps within small cap equities). This micro pattern is as well very useful for large-cap traders who trade flagship tickers such as stocks part of VUG ETF, as those patterns are frequent and present a robust approach on picking the bottoms in pullback legs of such assets.

Very good writeup, learned a lot of stuff

Fantastic article. read every word and saved every chart. thank you